1500+

Clients

1800+

Companies formed

150+

Countries served

5+

Years of experience

Why Privatily?

Simply because we know how to take the complexity out of forming your LLC, Privatily offers unmatched expertise since 2019, guaranteeing the best prices and the quickest turnaround time, ensuring you can start your business journey smoothly and swiftly at such an affordable price.

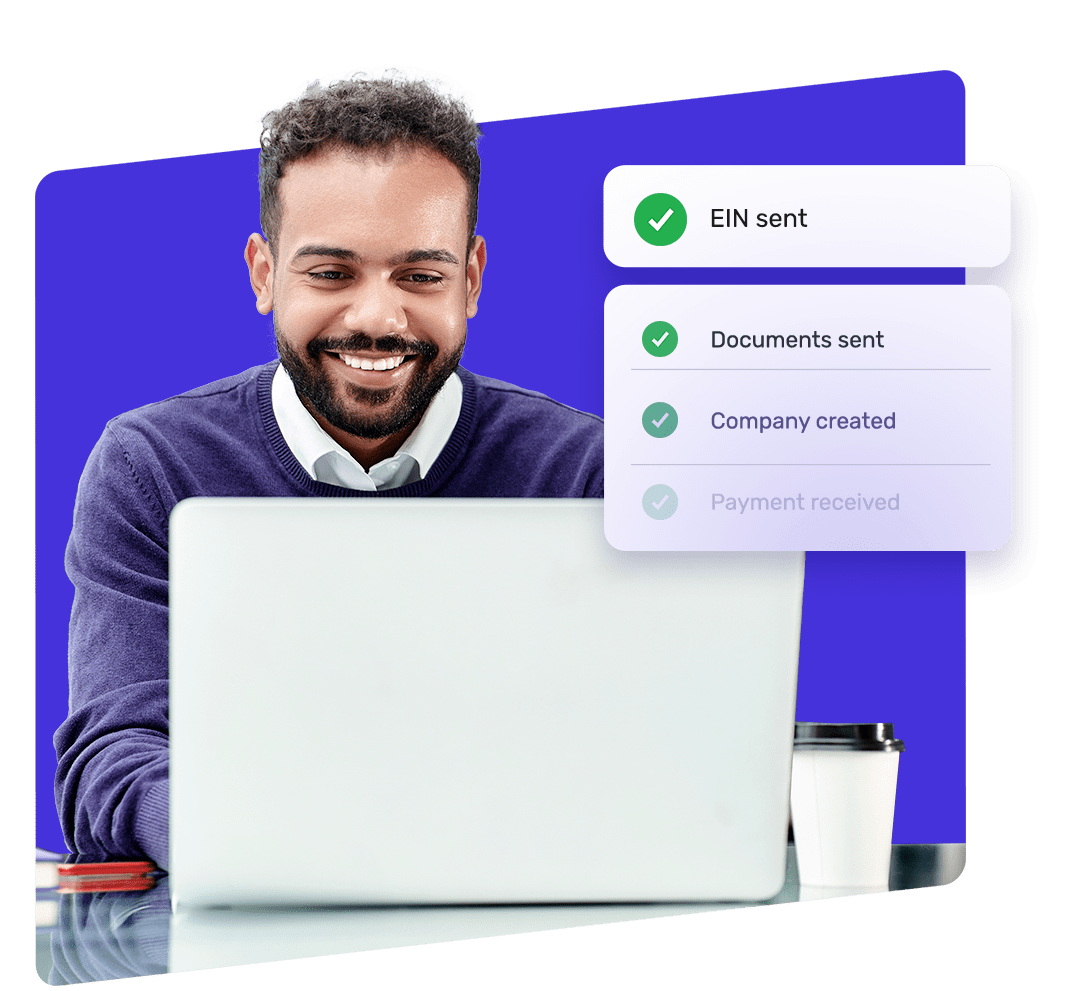

How much time do we need?

At Privatily we count delivery time by business hours, not by days or weeks like others do.

However, please be aware that these timelines are applicable only if you opt for LLC registration in one of our recommended U.S. states: Colorado, New Mexico, Montana, or Wyoming.

Why Incorporate In The US

Trust

Forming a company in the US is viewed as more trustworthy by financial service providers, like Stripe, PayPal and banks due to the nation’s established business infrastructure and stringent regulatory environment.

Protection

A US-based company provides a legal separation between a business and its owners, known as limited liability protection. This means that in the event of lawsuits or debts, personal assets of the owners are generally protected.

Prestige

A US company can lend prestige and credibility to a business. The US is often seen as a leader in innovation and entrepreneurship, and having a US-based company can enhance the reputation of a business both domestically and internationally.

Trusted by entrepreneurs

from 150+ countries

Their speed and prices are unmatched! Starting my business in the U.S. with Privatily was very easy. Their team took care of everything, and I really can’t thank them enough.

Yusuf

From Pakistan 🇵🇰

Their speed and prices are unmatched! Starting my business in the U.S. with Privatily was very easy. Their team took care of everything, and I really can’t thank them enough.

Yusuf

From Pakistan 🇵🇰

Their speed and prices are unmatched! Starting my business in the U.S. with Privatily was very easy. Their team took care of everything, and I really can’t thank them enough.

Yusuf

From Pakistan 🇵🇰

Bonuses for Premium clients only

Transparent Pricing

As a Premium client, we’ll assist you in setting up all the financial services available to you. You’ll have a dedicated account manager and our exceptional support team, ready to assist you via chat, email, and phone.

Our Mission at Privatily

Simply because we know how to take the complexity out of forming your LLC, Privatily offers unmatched expertise since 2019, guaranteeing the best prices and the quickest turnaround time, ensuring you can start your business journey smoothly and swiftly at such an affordable price.

Frequently asked questions

For the US:

- Premium orders have a processing speed 3 times faster than Basic orders.

- We typically form companies within just 2 days.

- Securing the EIN takes an additional 4-7 days (Note: Most other providers require at least 2 weeks for EIN acquisition).

We need two things from you:

- Either your ID card or passport.

- Your bank statement or a utility bill that includes your name, address and dated within the last 3 months (it should have a date on it so we know when the document was created)

Absolutely, let’s break it down step by step:

- Pass-through Taxation: A US LLC is typically considered a “pass-through” entity. This means the company itself doesn’t pay taxes on its income. Instead, the profits (or losses) “pass through” to the owner and are reported on their personal tax forms.

- US Source Income: If your US LLC makes money from selling goods or providing services within the US, you might owe taxes on that income. This can vary depending on the state your company is registered in.

- No US Activities: If your LLC doesn’t do business within the US and you, as the owner, aren’t a US resident, then typically you won’t owe US federal income tax. However, you should always check the local tax rules of the state where your LLC is formed.

- Annual Reports: While this isn’t a tax, many states require LLCs to submit an annual report and pay a fee. This keeps your company in good standing.

- Get Expert Advice: Tax rules can be complex, especially if you’re doing business in multiple countries or states. It’s a smart move to consult with a tax expert who can guide you based on your specific business situation.

Remember, staying informed and compliant is key to ensuring your business runs smoothly!

Absolutely, except if you’re from Russia.

We have answers for so many other questions in our Knowledgebase,

Check our helpdesk articles.

Or you can simply ask our Support team and we’ll be more than happy to help!

Launch your company from

→ anywhere

Act now! Gain exclusive access to top-tier financial solutions, reserved solely for US-based companies, and significantly boost your business’s potential for success.

Reach Out, We're Here to Help!

Complete the form, and our team will promptly respond to your inquiry within our working hours!

Send us a message